Compliment of the Month: international battery market study Rabobank

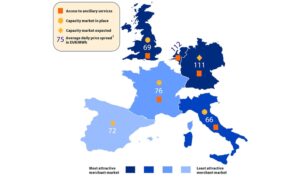

In each month's "compliment of the month" message series, we want to highlight a stakeholder who, in his or her own way, is trying to accelerate energy storage. For the month of February, our compliment goes to Rabobank. In fact, early this year, Rabobank conducted an in-depth analysis of the differences in battery markets in Germany, the UK, France, Spain, Italy and the Netherlands. This examines, among other things, which country has the most attractive battery market.

The bank concludes that the Netherlands, with its high share of renewable energy sources, offers interesting opportunities for investment in Battery Energy Storage Systems (BESS). At the same time, however, there are challenges that make the market less attractive than in countries such as Germany, the United Kingdom and Italy. In this article, we look at the research from Rabobank's perspective and describe how the Netherlands compares to other European markets and what the opportunities and obstacles are for investors.

High price volatility and energy mix as opportunity

The Netherlands has experienced strong growth in wind and solar energy in recent years. Whereas in 2015 the share of intermittent sources was still between 25% and 40%, by 2024 it will have increased to 50-60%. By 2030, this is expected to increase even to 80%. This high share of renewable energy leads to significant fluctuations in electricity prices, providing BESS projects with opportunities for energy arbitrage. During the day, when solar power is abundant, prices can even become negative, while gas-fired power plants provide high price peaks in the evening and at night. The Netherlands has one of the highest price differentials in Europe, comparable to Germany.

Grid congestion and infrastructure as a challenge

One of the biggest obstacles to BESS in the Netherlands is limited grid capacity. The Dutch power grid suffers from severe congestion problems, making it difficult to connect new storage projects. Although there are ambitious grid investment plans, the queues for new projects remain long. This problem also plays out in Germany, where the grid queue for renewable projects and storage is growing rapidly. In countries such as France and Italy, grid congestion is less of a problem, which facilitates the development of BESS projects.

Market structure: advantages and limitations

The Dutch wholesale market offers attractive arbitrage opportunities due to high price volatility. This is especially advantageous for short-term trading and rapid storage capacities. However, unlike countries such as Spain and Italy, the Netherlands has hardly any hydropower plants that can serve as a natural buffer. This increases the need for battery storage for grid balancing.

The Netherlands has an active balancing market in which BESS can participate in daily auctions for frequency maintenance and automatic frequency restoration. Prices in this market are attractive and similar to those in Germany. This provides a stable revenue source for storage projects. At the same time, however, the Netherlands does not have a capacity market, meaning that there is no additional compensation for available storage capacity, as is the case in the United Kingdom, France and Italy.

Policy and regulation: the Netherlands less attractive

Another important aspect in assessing the Dutch BESS market is the policy environment. The Netherlands has relatively high transmission tariffs and offers few subsidies for energy storage. In Germany and Italy, for example, residential batteries are generously subsidized, stimulating market growth. In the United Kingdom, policy focuses on facilitating BESS projects, in part by avoiding double grid costs. Spain is developing new incentives, while France lags behind on storage policies.

Conclusion: the Netherlands offers opportunities, but also challenges

The Netherlands has strong assets for BESS investment, particularly due to its high price volatility and active balancing market. This makes the country attractive for companies looking to take advantage of energy arbitrage and short-term trading. Yet there are significant obstacles, such as grid congestion, lack of a capacity market and lack of incentive policies. This places the Netherlands behind Germany, the United Kingdom and Italy as an investment destination for BESS projects.

For investors, this means that careful consideration is needed. Projects focused on flexibility and arbitrage may pay off well in the Netherlands, but long-term storage projects with a focus on stable revenue streams are likely to be more successful in countries with a capacity market and stronger policy support. Therefore, the future of the Dutch BESS market depends heavily on how quickly infrastructure is improved and whether regulations become more favorable to energy storage initiatives.

Read the entire report here: https://www.rabobank.com/knowledge/d011462339-backup-power-for-europe-part-1-country-attractiveness-for-battery-energy-storage-systems

| Factor | Netherlands | Germany | United Kingdom | France | Spain | Italy |

| Share of wind & solar energy (2024) | 50-60% | 50-60% | 50-60% | 30-40% | 50-60% | 50-60% |

| Expected share in 2030 | 80% | 80% | 80% | 50% | 80% | 80% |

| Price volatility in wholesale market | High (similar to Germany) | Highest in Europe | Moderate | Low (due to stable nuclear power) | Moderate (due to hydro storage) | Moderate (due to hydro storage) |

| Balancing market (grid stability) | Attractive, high prices | Very attractive, highest prices | Active, but already highly saturated | Small, few opportunities for BESS | Limited, regulations under development | Only through long-term contracts |

| Capacity Market | Not available | Expected in future | Active | Active | In preparation | Active |

| Grid congestion | High, inhibits growth BESS | Very high, large queue for new projects | Moderate | Low | Moderate | Moderate |

| Grants and financial support | Low, high transportation rates | High, subsidies for residential storage | Medium, no double grid costs | Low | Moderate | High, grants and storage strategy |

| Future investments in the grid | Ambitious, on top of wind and solar plans | High, including HVDC projects | High | Behind schedule | Sufficient | Sufficient |

| Market complexity and regulation | Challenging, but opportunities | Relatively simple and attractive | Well-developed but competitive | Difficult, few market opportunities | Under development, still uncertain | Regulatory appeal and growth |

| BESS capacity already installed. | Limited | High, especially residential batteries | High, most large-scale BESS | Low | Limited, but growing | High, supported by grants |

| Overall market attraction for BESS | ⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐ | ⭐⭐ | ⭐⭐⭐⭐ |